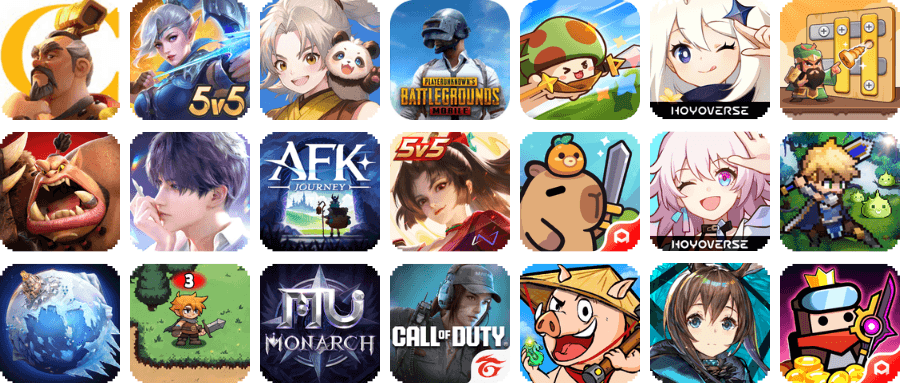

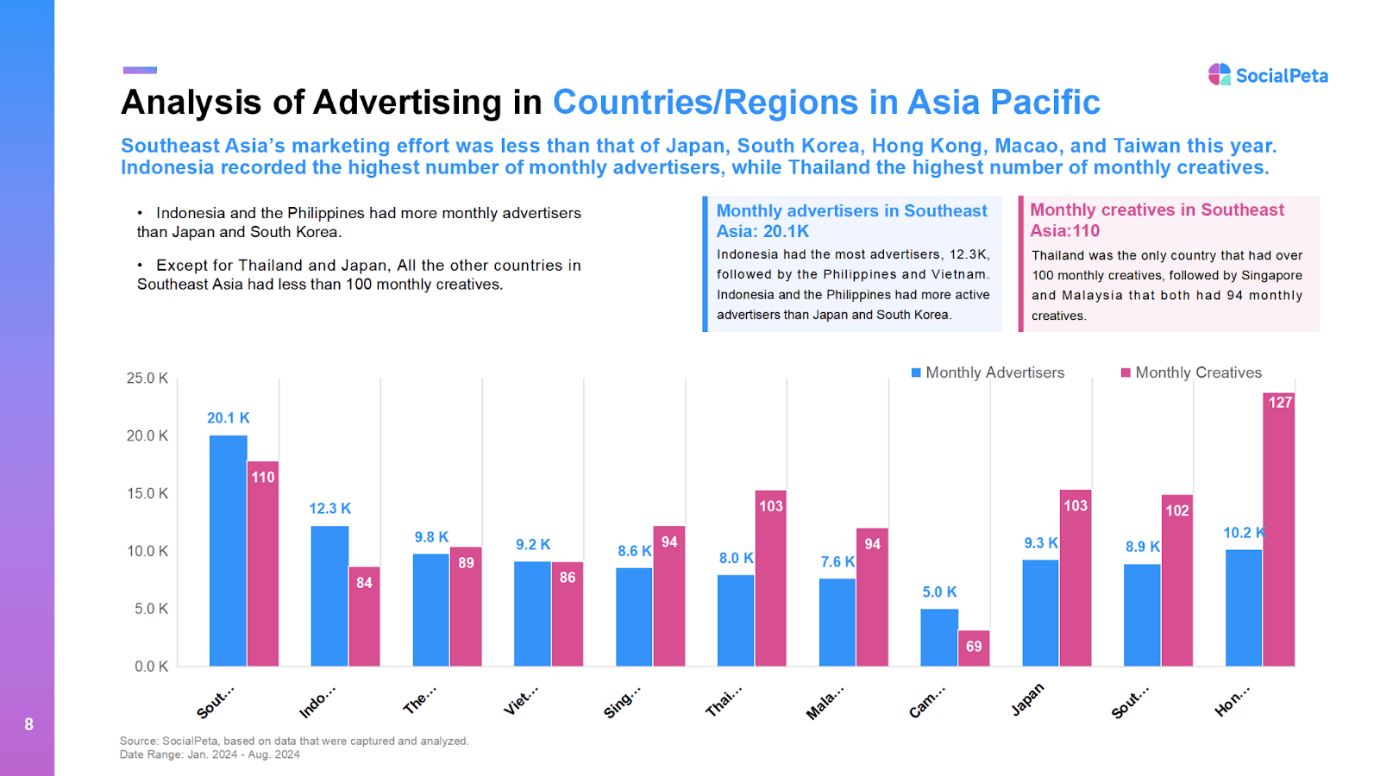

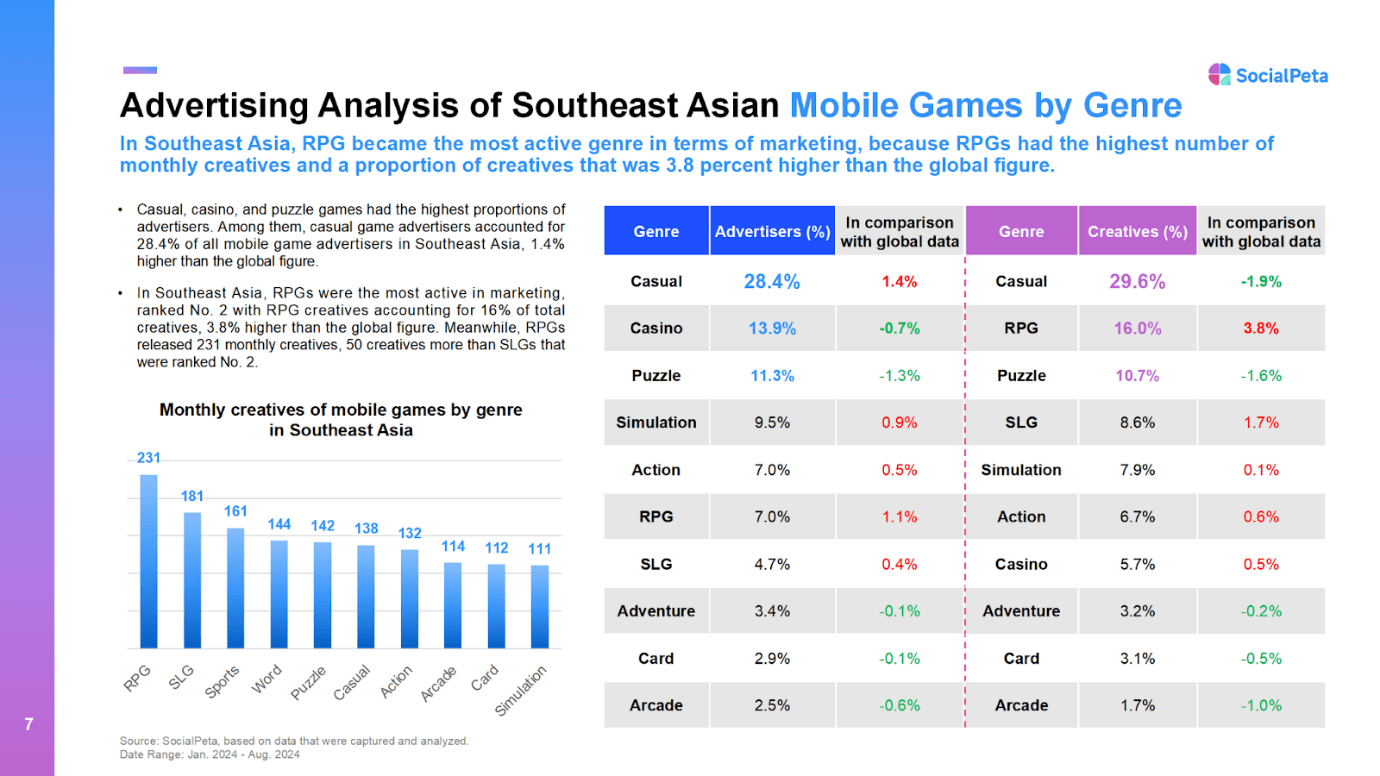

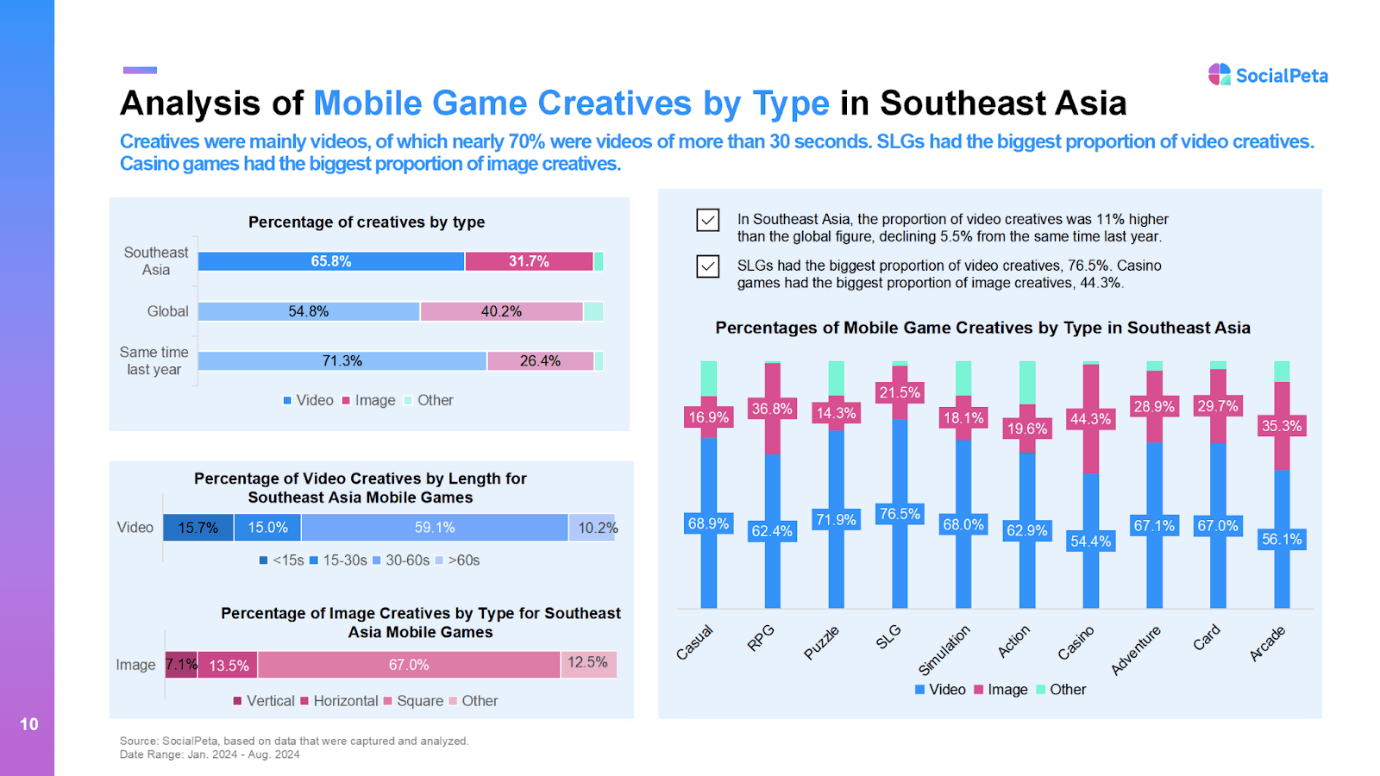

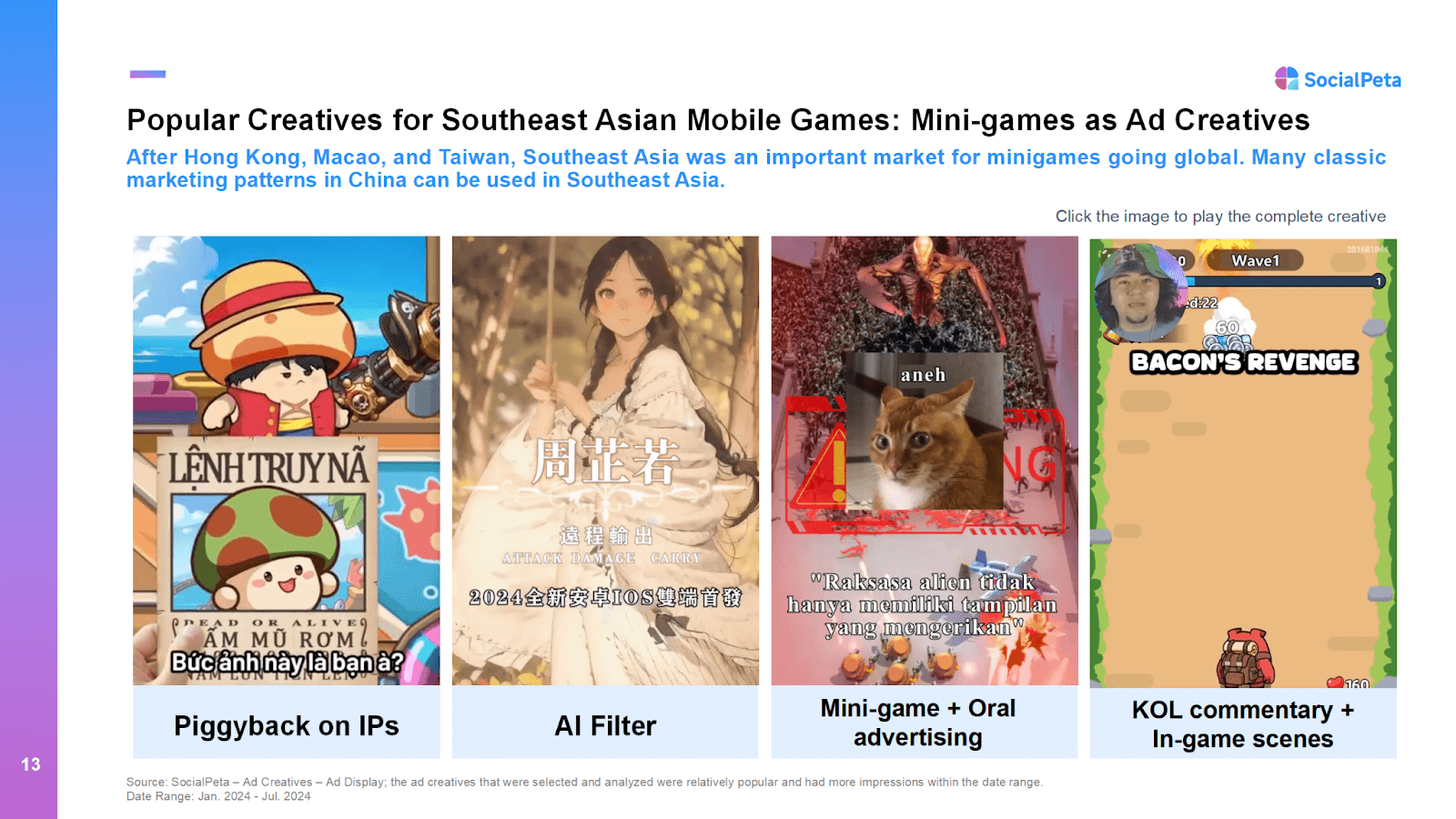

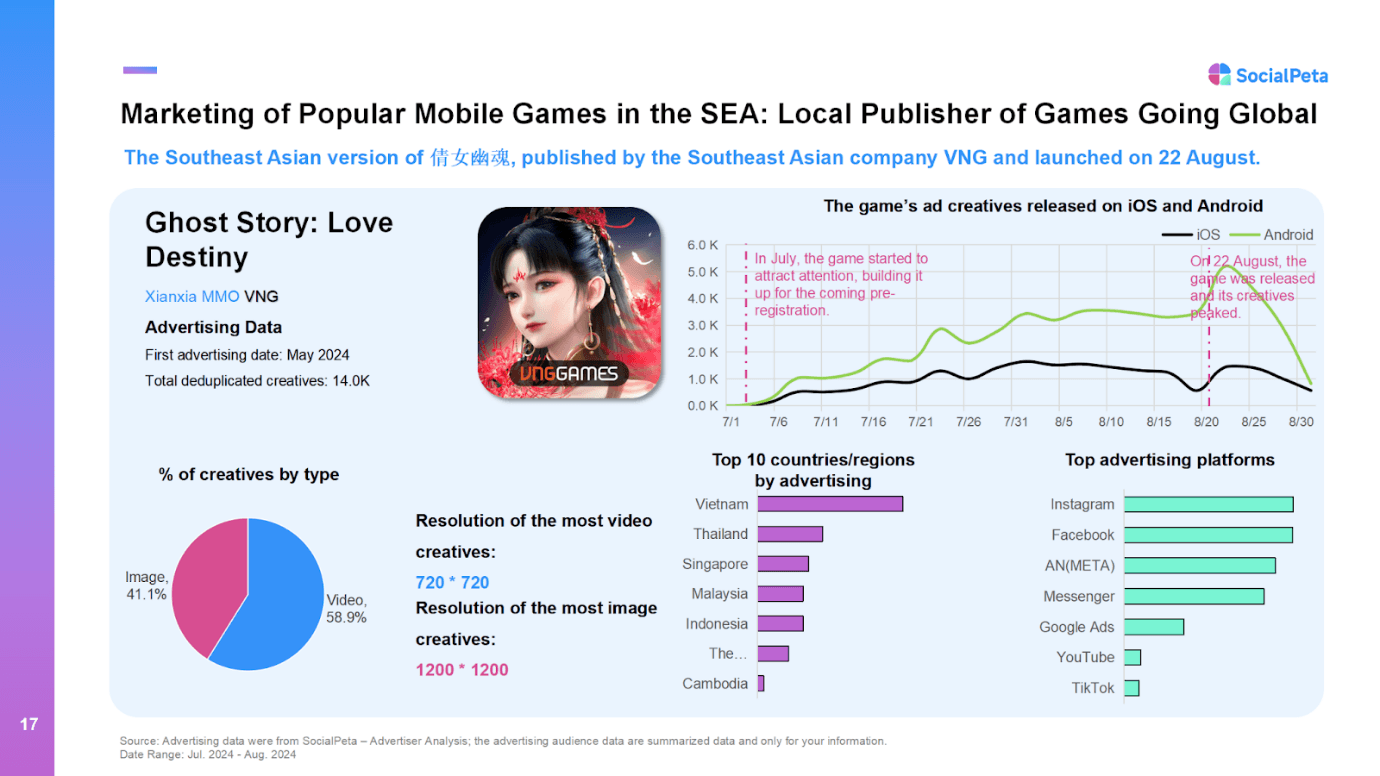

Top-performing overseas mobile game icons in the Southeast Asian market Source: SocialPeta In 2024, the Southeast Asian mobile game market experienced steady growth, with over 21,000 active advertisers per month on average—a 9.5% year-on-year increase—despite a brief decline in June and July. Overall, market performance remains strong. New advertisers performed well in 2024, maintaining an average of 3.7% throughout the year and peaking at 8.5% in June, indicating a significant influx of new games. Despite lower numbers during the Lunar New Year period, the growth trajectory of the Southeast Asian mobile game market remains positive. Marketing trends in Southeast Asia Click on image for full size. Source: SocialPeta In 2024, new creative placements in the Southeast Asian mobile game market showed notable shifts. In July and August, 63.8% of advertisers launched new creatives, reaching the highest levels of the year despite a slight 0.8% year-on-year decrease. On average, 39.6% of creatives were new, with a peak of 49.1% in June. These figures emphasize advertisers’ focus on updating creatives, especially mid-year, to boost ad appeal and engagement. New ad creatives Click on image for full size. Source: SocialPeta Click on image for full size. - Advertisement - Source: SocialPeta RPGs (role-playing games) are the most competitive advertising category in Southeast Asia, averaging 231 creatives per month—16% of the total and 3.8 percentage points above the global average. This volume far exceeds other categories, surpassing strategy games by 50 creatives. Casual games lead in advertiser share, comprising 28.4% of the market, which is 1.4 percentage points higher than the global average. However, their share of creatives is 29.6%, 1.9 percentage points below the global average. Casino and puzzle games follow closely, accounting for 13.9% and 11.3% of advertisers, respectively. Mobile games by genre Click on image for full size. Source: SocialPeta In Southeast Asia, mobile game advertising prioritizes video creatives, which make up 65.8% of all ads—above the global average of 54.8%, though down from 71.3% last year. Notably, nearly 70% of these videos are longer than 30 seconds, suggesting that longer ads are more effective in the region. Strategy games top the list, with 76.5% of their ads in video format, while casino games rely more heavily on image creatives, which account for 44.3%. Most video ads fall between 30 and 60 seconds, representing 59.1% of the total. For image ads, 67% are in landscape format, while portrait and square images make up 13.5% and 7.1%, respectively. This data highlights the variety of creative types and advertising strategies used across different game genres in Southeast Asia. Mobile game creatives by type Click on image for full size. Source: SocialPeta Southeast Asia has emerged as a key battleground for the overseas expansion of mini-games, following regions like Hong Kong, Macau, and Taiwan. Numerous classic domestic marketing strategies have been successfully adapted to this region, showcasing a diverse range of creative formats. Popular creatives Click on image for full size. Source: SocialPeta Click on image for full size. Source: SocialPeta The 24-page report includes data up to August 2024. Through an in-depth analysis of Southeast Asian mobile game marketing data, alongside comparisons with past international marketing trends, SocialPeta has compiled this report to support your journey into global markets and aid in your expansion efforts. Download the full report to stay ahead in the ever-evolving mobile gaming landscape.

The average number of monthly advertisers exceeded 21,000, with new creatives accounting for nearly 70% in July and August.

Strategy games lead in video creatives, while mini-games capture attention with IP-based elements.

2024-11-04 10:58:22

Southeast Asia mobile game report

| Name | |

|---|---|

| Publisher | |

| Genre | games news |

| Version | |

| Update | ديسمبر 11, 2024 |

| Get it On |

|